2023-24 financial year in review

08/07/2024

Bob Cunneen, Senior Economist and Portfolio Specialist, MLC Asset Management

“A surprisingly great year for global shares despite significant inflation, interest rates and political risks.”

Global inflation has fallen but the ‘cost of living’ remains a worry for consumers

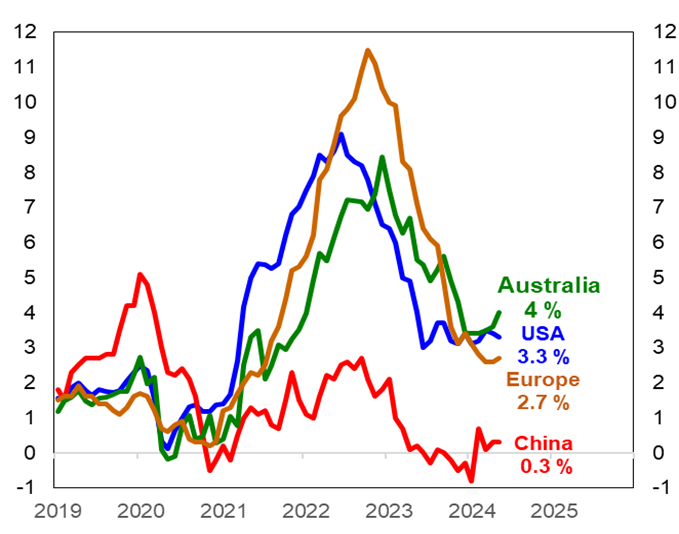

Global inflation has gradually cooled in the past year after the intense heat of 2021-2022 (Chart 1). Lower prices for key commodities (such as natural gas and wheat) as well as improving production and transport supply chains have lowered the temperature of inflation. However, consumer inflation has recently become sticky and stubborn around the 3% to 4% annual rate in both Australia and the US. This stickiness in inflation is a result of more persistent price pressures in food, health care, insurance, and rents. Hence for many households, the ‘cost of living’ crisis is continuing. Europe has made more progress on lowering inflation towards a 2% annual rate. China remains the exception to the global inflation challenge with inflation barely registering a pulse.

Chart 1: Global consumer inflation

Sources: Australian Bureau of Statistics, Eurostat, National Bureau of Statistics of China and US Bureau of Labor Statistics.

For Australian consumers, the painful squeeze from rising prices is most evident in the struggle to keep food on the table and a roof over our heads. Australian food products have risen by circa 3%, health care by 6%, rents by 7% and insurance by nearly 8% in the year to May. Those with housing mortgages have also endured the squeeze with high interest rates on their loans.

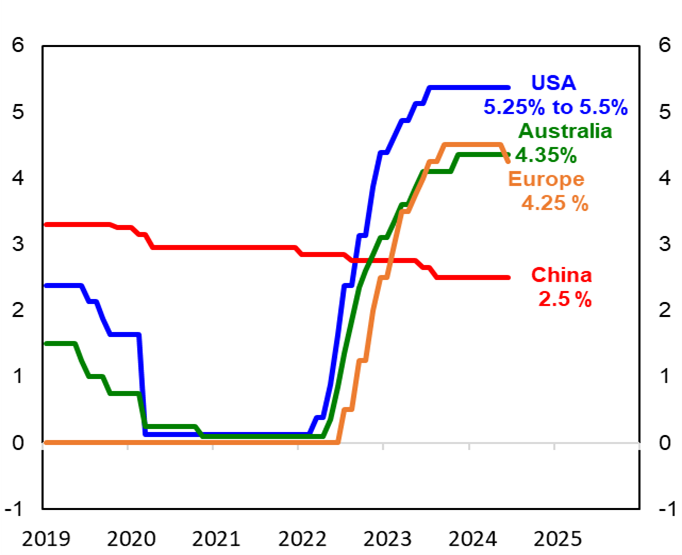

Chart 2: Central banks are now either holding or cutting interest rates

Sources: Reserve Bank of Australia statistical table International Official Interest Rates - F13.

A ray of sunshine is that global interest rates appear to have peaked (Chart 2). Most central banks around the world are holding cash interest rates steady. Some central banks have even cut interest rates given subdued economic activity and fading inflation (notably China and Europe). The Reserve Bank of Australia (RBA) is an exception by still signalling a more cautious tone on interest rate prospects given “persistent” inflation. Essentially the RBA is “not ruling anything in or out” on interest rates given the “uncertain” inflation path.

The past year has also provided dramatic and terrible political shocks. The October 2023 Hamas attack on Israel generated considerable tragedy and turmoil in the Middle East. Russia’s devastating invasion of Ukraine in 2022 is still casting a shadow over Europe and remains a threat to political stability. Fortunately, Ukraine’s brave defence has stalled the larger Russian army, but this remains a conflict with no end in sight.

The global economy has provided both positive and negative surprises

Global economic activity has been ‘multi-speed’ in the past year. The US economy has been a continuing source of strength. American businesses and consumers have kept spending despite the headwinds of higher interest rates and inflation. Strong jobs growth has allowed the unemployment rate to remain stable at around 4% and supported wages. Even the US housing market has been solid with house prices making gains.

European economic activity has stagnated over the past year with flat economic activity. Germany’s status as Europe’s ‘industrial powerhouse’ has lost steam given weaker export demand for luxury cars and chemicals. The UK has also struggled as consumers have trimmed their spending given inflation and higher interest rates.

China’s economic growth in the past year has been constrained by a cautious consumer and weak property market. Falling property prices and the financial troubles of key property developers such as Evergrande & Country Garden have undermined confidence in China’s economy. Amongst Australia’s other major trading partners, the economic news has been more mixed. Japan has also struggled with subdued consumer spending and weak exports. There has been a more positive performance from India in the past year with economic growth near 8% compared to China’s 5% pace.

Australia’s struggling economy with persistent inflation is troubling

Australia’s economy has been subdued in the past year. The negative impact of persistent inflation, rising mortgage interest rates and rents have generated a very ‘painful squeeze’ for Australian households. Indeed, the RBA’s May 2024 statement remarked that “households are budget-conscious and seeking value” by “trading down to cheaper products”. Notably the Australian economy is in a ‘per capita’ recession where population growth at circa 2.5% exceeds annual real economic growth at 1.1% for the March quarter.

The RBA raised the cash interest rate to 4.35% in November 2023 given the judgement that inflation was “still too high and is proving more persistent than expected.” Consumer inflation has proven stubborn at around 4% since then, which has led to concern that interest rates will remain ‘higher for longer’.

Yet there has been some positive news. Australia’s labour market has recorded solid job gains and the unemployment rate remains low at 4%. Business investment and government infrastructure spending have made strong contributions to job gains as well as broader economic activity. There are some hopeful signs for a boost to Australian economic activity and lower inflation outcomes for next financial year with the recent Federal and State Government Budget stimulus measures such as income tax cuts, electricity rebates and rent assistance.

A strong year for investment returns

Table 1: Asset class returns in Australian dollars – periods to 30 June 2024

Asset class |

Returns |

|||

1 year |

3 yrs (pa) |

5 yrs (pa) |

10 yrs (pa) |

|

Cash |

4.4% |

2.4% |

1.6% |

1.9% |

Australian bonds |

3.7% |

-2.1% |

-0.6% |

2.2% |

Global bonds (hedged) |

2.7% |

-2.7% |

-0.7% |

2.0% |

Global high yield bonds (hedged) |

8.0% |

0.1% |

2.5% |

3.9% |

Global listed infrastructure (hedged) |

4.3% |

2.2% |

2.5% |

5.9% |

Global property securities (hedged) |

4.6% |

-4.1% |

-1.1% |

3.1% |

Australian shares |

11.9% |

6.1% |

7.2% |

8.0% |

Global shares (unhedged) |

19.0% |

9.6% |

11.9% |

12.3% |

Global shares (hedged) |

19.4% |

5.7% |

10.0% |

9.4% |

Emerging markets (unhedged) |

12.2% |

-1.3% |

4.1% |

6.4% |

Past performance is not a reliable indicator of future performance.

Sources: FactSet, MLC Asset Management Services Limited. Benchmark data: Bloomberg AusBond Bank Bill Index (cash), Bloomberg AusBond Composite 0+ Yr Index (Aust bonds), Bloomberg Barclays Global Aggregate Index Hedged to $A (global bonds), FTSE Global Core Infrastructure 50/50 Index Hedged to $A, FTSE EPRA/NAREIT Developed Index (net) hedged to $A (global property securities), S&P/ASX200 Total Return Index (Aust shares), MSCI All Country World Indices hedged to $A and unhedged (net) (global shares), and MSCI Emerging Markets Index (net) unhedged to $A (emerging markets).

Global shares experienced considerable turbulence during the financial year but still managed to climb the ‘wall of worries’. Inflation concerns, rising interest rates, as well as the tragic Russian-Ukraine War and Hamas-Israel conflict have provided significant headwinds to global share markets.

Encouragingly, global share returns have been very strong for the past year. Optimism over the promise of ‘Artificial Intelligence’ (AI), modest progress towards lower global inflation and the encouraging resilience of the US economy have been the major drivers of global share markets.

Global shares (hedged) recorded a 19.4% return for the year in local currency terms. However, gains in the Australian dollar over the past year served to temper the global shares (unhedged) return to 19.0%.

Investor’s enthusiasm for technology has been the key positive driver of global share returns. The largest AI chipmaker in Nvidia led the charge with a 192% price gain for the year. Notably, Nvidia briefly achieved the title of the “world’s most valuable company” in June 2024 before Microsoft regathered the title to end the year with a 31% annual gain. There were also very strong price gains from large technology companies such as Meta/Facebook (76%), Alphabet/Google (53%) and Amazon (48%). These extraordinary gains allowed the US technology focused NASDAQ Composite Index to post a 29.6% annual return, in local currency terms, and for the broader S&P 500 Index to return 24.0%, in local currency terms.

European shares made solid returns for the year. A clear standout was the 83% price gain for Novo Nordisk which has become Europe’s largest company on the back of the diabetes and weight loss drug Ozempic. The chipmaker ASML rode the technology wave with a 48% gain to become Europe’s second most valuable firm.

Asian share markets were mixed. Chinese share prices continued to struggle with a -1.9% negative annual return, in local currency terms, given subdued economic activity and a very weak property market. Notably property developer Evergrande entered bankruptcy proceedings on foreign borrowings in August 2023 while rival Country Garden is on shaky ground. By contrast, Japan’s share market made very strong annual gains of 21.5%, in local currency terms, with the benefit of the central bank keeping interest rates 0% and a weak currency boosting exporters like Toyota with a 42% price gain for the year.

Emerging markets delivered a strong return of 12.2% on an unhedged basis. India was a key positive contributor with robust share returns (MSCI 36.6% in local currency terms) given strong economic growth and technology optimism. Yet India’s share price gains were tempered in June 2024 by the failure of Prime Minister Narendra Modi to secure a clear parliamentary majority for a third term in office.

Australian shares as measured by the ASX 300 made a strong 11.9% return for the year. The sharpest annual gains were in Information Technology (28.2%), which accords with the global enthusiasm, while the Financial (29%) and Consumer Discretionary (22.3%) sectors delivered surprisingly strong gains despite the challenge of higher inflation and interest rates squeezing consumers. The clear standouts were the major banks with NAB (34.5%), Westpac (32.7%) and CBA (32.5%) delivering remarkable gains.

However, Australia’s Resources sector was a major disappointment with a negative return of -3.2% given concerns over China’s growth prospects. Notably Australia’s most valuable public company in BHP delivered a 0% return given lower iron ore prices. Lower lithium prices also played havoc and generated pain in the Resources sector total returns with Pilbara Metals (-33.5%) and Mineral Resources ( -22.6%) both down for the year.

Australian bonds managed a solid 3.7% annual return while global bonds (hedged) delivered a modest 2.7% return. The gradual progress to lower global inflation encouraged investors that interest rate cuts are coming sometime in the future. Global high yield bonds (hedged) made a very strong 8.0% annual return as investors considered the elevated yield of these corporate bonds attractive.

Global prospects

Global share prices have made very strong gains in the past financial year. The enthusiasm for AI and broader technology prospects have been the key drivers. There is also confidence that the global inflation threat has faded enough to allow interest rates to fall in the coming year.

However, these exuberant expectations may not be realised if inflation proves more persistent and central bankers are more stubborn in lowering interest rates. The continued tragic Russia-Ukraine War and Hamas-Israel conflicts and the potential for further escalation are key threats to global economic stability. Investors will also need to contend in the US Presidential and Congressional elections in November 2024 which could dramatically transform the global political landscape if Donald Trump takes the Oval Office.

Accordingly, there are significant inflation, interest rate and political risks that investors should be cautious of. Assessing these complex risks is very challenging given the potential for shocks. Given there are multiple outcomes possible over the next year, investors should maintain a disciplined and diversified strategy.

Important information

This communication is provided by NULIS Nominees (Australia) Limited (ABN 80 008 515 633, AFSL 236465) as trustee of Plum Super the MLC MasterKey Fundamentals Super and Pension and MLC MasterKey Business Super products which are a part of the MLC Super Fund (ABN 70 732 426 024 (together ‘MLC’ or ‘we’), part of the Insignia group of companies (comprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate) (‘Insignia Financial Group’). The capital value, payment of income and performance of any financial product referred to in this communication are not guaranteed. An investment in any financial product referred to in this communication is subject to investment risk, including possible delays in repayment of capital and loss of income and principal invested. No member of the Insignia Financial Group guarantees or otherwise accepts any liability in respect of any financial product referred to in this communication.

The information in this communication may constitute general advice. It has been prepared without taking account of an investor’s objectives, financial situation or needs and because of that an investor should, before acting on the advice, consider the appropriateness of the advice having regard to their personal objectives, financial situation and needs. Investors should obtain the relevant Product Disclosure Statement or other disclosure document relating to any financial product which is issued by MLC, and consider it before making any decision about whether to acquire or continue to hold the product. A copy of the Product Disclosure Statement or other disclosure document is available on mlc.com.au or plum.com.au.

Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market. The performance returns in this communication are reported before deducting management fees and taxes unless otherwise stated. Actual returns may vary from any target return described in this communication and there is a risk that the investment may achieve lower than expected returns. Any projection or other forward-looking statement (‘Projection’) in this document is provided for information purposes only. No representation is made as to the accuracy or reasonableness of any such Projection or that it will be met. Actual events may vary materially.

This information is directed to and prepared for Australian residents only. Any opinions expressed in this communication constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to their accuracy or reliability (which may change without notice) or other information contained in this communication.

MLC may use the services of any member of the Insignia Financial Group where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.

Bloomberg Finance L.P. and its affiliates (collectively, ‘Bloomberg’) do not approve or endorse any information included in this material and disclaim all liability for any loss or damage of any kind arising out of the use of all or any part of this material. The funds referred to herein is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds.