Australia’s lower inflation is yet to convince the Reserve Bank of Australia

October 2024

Bob Cunneen, Senior Economist and Portfolio Specialist

5 min read

Australia’s inflation has declined and is finally within the RBA’s 2% to 3% target band. However, the RBA is concerned that inflation is set to rise again next year. Given the more likely prospect is for a subdued Australian economy with consumers still struggling in 2025, the threat of rising inflation appears overstated.

Australia’s inflation moderates but the central bank castigates

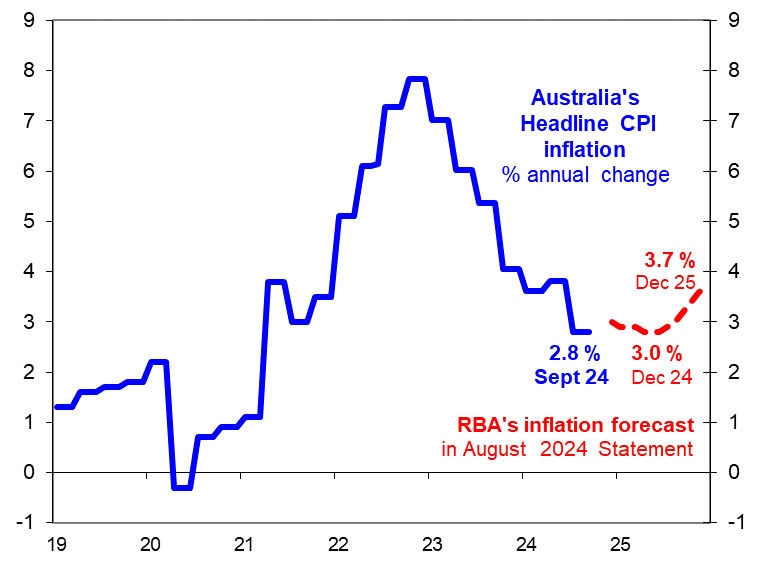

In welcome news, Australia’s annual consumer inflation rate has finally fallen below 3% for the first time since 2021. For the year to September 2024, inflation came in at 2.8% (Chart 1). After the peak of 7.8% in December 2022, Australia’s inflation has been gradually falling. Yet the Reserve Bank of Australia (RBA) appears less than impressed even with inflation now back to the central bank’s 2% to 3% target range. The RBA is adamant that inflation is still a threat. Indeed, the RBA is forecasting that inflation will rise back to 3.7% by the end of 2025.

Chart 1: Australian consumer inflation

Sources: Australian Bureau of Statistics and Reserve Bank of Australia.

Why has Australia’s inflation rate declined in the past year?

Australian consumers can find some solace from lower electricity prices through various government programs. As noted by the Australian Bureau of Statistics (ABS):

“Electricity prices fell 17.3 per cent in the September quarter and 15.8 per cent in the past 12 months. The introduction of the 2024-25 Commonwealth Energy Bill Relief Fund (EBRF) rebates and State government rebates in Queensland, Western Australian and Tasmania from July drove the fall this quarter.”

There have also been falls in consumer prices for automotive fuel (-6.2% over the year to September), furniture (-5.3%), major household appliances (-1.7%), footwear (-1.3%) and even cheese (-2.2%).

A “cost of living” crisis is still evident in the “essentials”

There are more persistent price pressures in health care, insurance and rents that remain troubling for consumers. In the year to September 2024, hospital and medical costs have risen by 5.6%, rents by 6.7% and insurance by 14%. (Chart 2). These services prices have been consistently rising over the past three years. Indeed, these price pressures are resistant to both consumer angst and the ‘painful squeeze’ on weekly budgets. The key problem for consumers is that medical, rents and insurance are effectively ‘essentials’ in which the consumer has little choice but to pay the price. For the RBA, the problem is that these ‘essentials’ are not responsive to higher interest rates reducing demand and thereby prices. The persistent inflation results in these “essentials” reflects a mix of specific challenges. These challenges include that Australia’s ageing population have more complex and costly medical needs, a lack of new housing construction over the past decade to meet a growing population and for insurance, a profound lack of competition and transparency.

Chart 2: Australia’s sticky price pressures

Source: Australian Bureau of Statistics.

Why is the RBA forecasting inflation to rise next year?

The RBA’s judgement is that electricity and rent subsidy measures are only temporary. Effectively, governments support measures have a ‘use by date.’ The primary illustration of this is the Federal Government’s $300 annual household electricity rebate is due to end in June 2025. For the RBA, their conclusion is that “the legislated unwinding of some policies in 2025 will push headline inflation to back above the target range” of 2% to 3%.

These are bold assumptions by the RBA on two counts. Firstly, that governments will readily take back from consumers these subsidies that are mitigating the “cost of living” crisis. Secondly that inflation pressures beyond the essentials (medical, insurance, rents) will continue to be troubling even when Australia’s economic prospects appear lacklustre. The RBA is optimistically assuming that with the benefit of “Stage 3” income tax cuts from July 2024 and solid income growth from wages, the Australian consumer is eager to spend.

Australia’s inflation is more likely to fall further rather than to climb again in 2025

Yet the RBA Board’s assessment from their last policy meeting in September was that Australia’s “household consumption had been notably weaker than expected.” Consumers are struggling to keep food on the table and the roof over their heads. Indeed, the RBA conceded that the forecast that “consumption growth would pick up” is at “risk” of being “delayed.”

Given the more likely prospect is for a subdued Australian economy with consumers still struggling in 2025, the threat of rising inflation in 2025 appears overstated. The RBA needs to be more realistic. Australian consumers require more assistance through continued government support measures and lower interest rates rather than the RBA’s warning of the “upside risks” in inflation.

Sources:

Australian Bureau of Statistics (ABS), Consumer Price Index, Australia for the September Quarter 2024 (released 30/10/2024).

Statement on Monetary Policy, August 2024, Reserve Bank of Australia, Forecasts (page 8).

Minutes of the Monetary Policy Meeting of the Reserve Bank Board – 23 and 24 September 2024.

Important information

This communication is provided by NULIS Nominees (Australia) Limited (ABN 80 008 515 633, AFSL 236465) as trustee of Plum Super the MLC MasterKey Fundamentals Super and Pension and MLC MasterKey Business Super products which are a part of the MLC Super Fund (ABN 70 732 426 024 (together ‘MLC’ or ‘we’), part of the Insignia group of companies (comprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate) (‘Insignia Financial Group’). The capital value, payment of income and performance of any financial product referred to in this communication are not guaranteed. An investment in any financial product referred to in this communication is subject to investment risk, including possible delays in repayment of capital and loss of income and principal invested. No member of the Insignia Financial Group guarantees or otherwise accepts any liability in respect of any financial product referred to in this communication.

The information in this communication may constitute general advice. It has been prepared without taking account of an investor’s objectives, financial situation or needs and because of that an investor should, before acting on the advice, consider the appropriateness of the advice having regard to their personal objectives, financial situation and needs. Investors should obtain the relevant Product Disclosure Statement or other disclosure document relating to any financial product which is issued by MLC, and consider it before making any decision about whether to acquire or continue to hold the product. A copy of the Product Disclosure Statement or other disclosure document is available on mlc.com.au or plum.com.au.

Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market. The performance returns in this communication are reported before deducting management fees and taxes unless otherwise stated. Actual returns may vary from any target return described in this communication and there is a risk that the investment may achieve lower than expected returns. Any projection or other forward-looking statement (‘Projection’) in this document is provided for information purposes only. No representation is made as to the accuracy or reasonableness of any such Projection or that it will be met. Actual events may vary materially.

This information is directed to and prepared for Australian residents only. Any opinions expressed in this communication constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to their accuracy or reliability (which may change without notice) or other information contained in this communication.

MLC may use the services of any member of the Insignia Financial Group where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.

Bloomberg Finance L.P. and its affiliates (collectively, ‘Bloomberg’) do not approve or endorse any information included in this material and disclaim all liability for any loss or damage of any kind arising out of the use of all or any part of this material. The funds referred to herein is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds.