US elections 2024: A guide for the perplexed

October 2024

Bob Cunneen, Senior Economist and Portfolio Specialist

8 min read

The US Election is still a close call. This election campaign has the potential for even more twists and turns over coming weeks. Investors will need to be mindful of the policies and promises of both current Vice President Kamala Harris and the former President Donald Trump.

Is Tuesday November 5th “D” Day for American Democracy?

The world’s oldest continuous democracy will once again be making profound choices in November. Both the American Presidency as well as control of Congress is decided on this ‘Super Tuesday’. There are 34 Senate seats out of 100 that are being contested. All 435 House of Representatives seats are also up for grabs. November’s election will thus determine who occupies the White House Oval Office as well as which party controls the legislative agenda in Congress.

Clearly there are sharp contrasts in the character of the Presidential candidates. Donald Trump’s unique maverick ‘my way or the highway’ approach is contrasted by the assertive ‘consensus building’ style of current Democrat Vice President Kamala Harris.

To gain the White House, the successful candidate must navigate a minefield of technical challenges. The first key hurdle is to get your supporters registered on the electoral rolls and then to get out and vote. Given that the first Tuesday in November is a typical workday, US elections have comparatively low turnouts compared to other democracies.

Secondly, the Presidency is not decided by an outright majority of US votes but by winning the majority of the 538 Electoral College votes. Hillary Clinton won the ‘popular vote’ in 2016 but failed to win the Presidency given that this is decided by the Electoral College result. For 48 of the 50 US states, Electoral College votes are allocated on a ‘winner take all’ basis. There are two exceptions being Maine and Nebraska which have proportional allocation. Hence, winning the Presidency is highly dependent on the actual distribution of voting across the states. So Presidential campaigns frequently focus on the key battleground states such as Arizona (11 Electoral College votes), Georgia (16 votes), Florida (30), Michigan (15), Ohio (17), Pennsylvania (19) and Wisconsin (10).

Can one forecast November’s election outcome?

Commentators and pollsters have tried to predict elections through various techniques. Voting polls, economic models, as well as betting market odds have been employed to predict the result. However, these various prediction methods have a mixed track record. The astonishing 2016 election result with Donald Trump being elected US President whilst commentators and polls favoured Hillary Clinton has seen many observers question whether elections are predictable.

Currently the polls favour Kamala Harris by an average margin of 2.4% according to RealClearPolitics.1 However, as individual polls generally have a margin of error of 3%, this is hardly a compelling lead to Harris. Given that some Trump voters also have a habit of hiding their support (witness the 2016 surprise result) and may be responding as notional Harris voters, then arguably the election still hangs in the balance.

Betting markets also favour Harris by 51.1% over Trump 47.6%.2 This is also a narrow lead and there is still potential for surprises over coming weeks. In terms of political commentators and their forecasting skills, the less said the better. Notably both the academic Allan Lichtman, who focuses on 13 political indicators to forecast elections (see the book “The Keys to the White House “) and the pollster Nate Silver (see “The Signal and the Noise”) currently favour Harris to win the Presidency. Yet Lichtman and Silver disagree forcefully on which methods should be used to predict why a Harris victory is likely.

Are there major economic policy differences between the two candidates?

The current US Vice President, Kamala Harris’ policy proposals closely echo those of President Joe Biden in many ways. Indeed, the Harris proposal for a rise in the corporate tax rate from 21% to 28% featured in Biden’s 2020 election campaign. This corporate tax rise was not implemented by President Biden given the opposition from a Republican controlled House of Representatives over the past four years.

The key aspects of the Harris proposals compared to Trump are outlined below with the costings estimates for the next 10 years provided by the Penn Wharton Budget Model (PWBM).3

The Harris policy proposal is a higher government spending and taxing profile compared to Trump. Clearly the Harris proposal to raise the corporate tax rate is in sharp contrast to President Trump’s agenda. This would reverse half of the corporate tax cut from 35% to 21% that was supported by President Trump and the Republican controlled Congress back in 2017.

However, Trump’s proposals would have a more dramatic impact on global trade and the US jobs market. Trump has proposed imposing 10% tariffs on all imports into the USA and specifically 60% on Chinese imports. Trump has also called for the deportation of “unauthorised” American workers who currently do not meet US citizenship requirements. This could see the exit of potentially 1.3 million to 8.3 million workers (circa 5% of the workforce) and lead to loss of economic activity in the agriculture, manufacturing, and mining sectors. The Peterson Institute estimates that under a 1.3 million worker deportation and tariff imposition strategy, the US economy will incur a loss of 1% of Gross Domestic Product and 0.5% increase in inflation by 2027.4

Yet both candidates would see increased US budget deficits for the next decade. According to the PWBM, Harris’ policy agenda would raise the budget deficit by “$1.2 trillion over the next 10 years on a conventional basis”. For Trump’s proposals, the increase would be “primary deficits by $5.8 trillion over the next 10 years”.

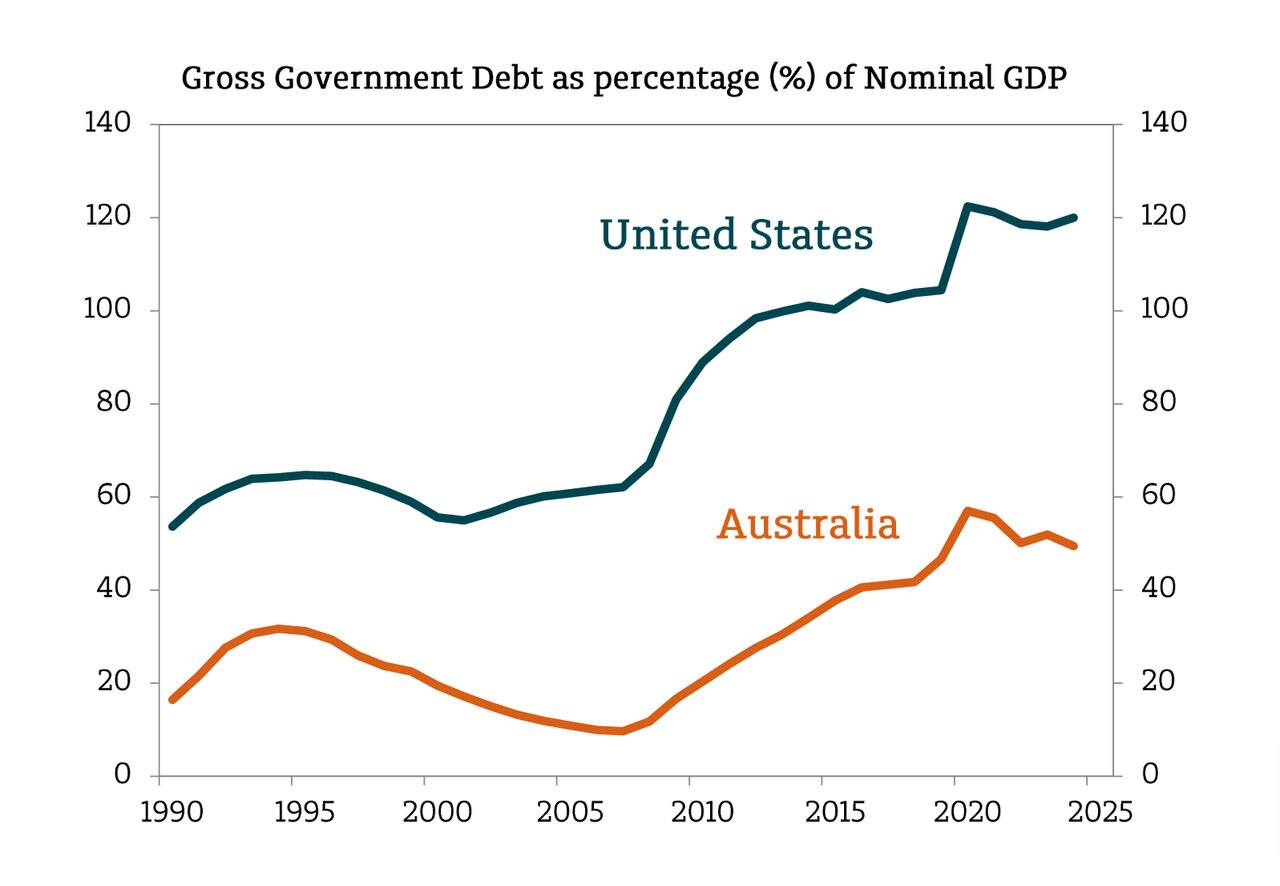

Given that the US Government is currently running a large budget deficit of US$1.9 trillion (circa -6.3% of GDP), both the Harris and Trump measures are likely to keep budget deficits very high and add to the national debt over coming years. This is a major concern given that US Government debt is estimated to be circa 120% of Gross Domestic Product. So, the USA is already a high debt country that is dependent on both domestic and foreign investors. By comparison, Britain’s Government Debt to GDP ratio is circa 101%, Canada is 106%, France is 112% and Italy is at 144% according to IMF data.5 Australia is a paragon of virtue by comparison with a lower Government Debt to GDP ratio at circa 50% (see chart).

So, a US government debt crisis over coming years is possible. This could be a short-term shock like Britain’s crisis in 2022 when the Truss Government proposal for tax cuts caused the UK government bond market to melt up in yields. Or this could be an even more dramatic and persistent crisis such as the European Debt Crisis in 2010-2012 where the spectre of default loomed over Greece, Italy, Spain, Portugal and Ireland.

As investors discovered during these respective debt crises and recent research has validated, the risk premium for government bonds surges higher:

“New evidence suggests that the increased risk premia provide compensation for larger fiscal risk; during periods of elevated debt, fiscal policy becomes more uncertain and less effective and can lead to debt crises.” 6

There is also a clear chasm between the candidates on key social policies such as reproductive rights, gun control and health care entitlements. The risk of deeper social divisions and polarisation may see investors question the future “safe haven” status of US government bonds and the return prospects of US share markets.

Clearly there is also the possibility that the new President will not have support from both the Senate and House of Representatives to pass these campaign promises. Currently the 100 seat Senate is controlled by the Democratic Party in a 51-49 majority. However, there are 34 Senate seats being contested at these elections with 23 Democrats facing election. The consensus is that the Republicans will narrowly regain control of the Senate in 2024. For the House of Representatives, all 435 seats are to be decided on November 5th. Republicans currently have a 220-207 majority, and expectations are for a cliff-hanger for 2024 as both Democrats and Republicans fight for a lower house majority.

Hence the new President may face considerable challenges in actually implementing their policies particularly if the Senate and/or House of Representatives is controlled by the opposing party.

Could a contested Presidential Election result see the winner decided by the Supreme Court?

President Trump’s combative character and the contested result of the 2020 election suggests that the 2024 election result could be disputed. The possibility of vote counting discrepancies and the importance of obtaining voting majorities across key states to win the Electoral College could provide evidence for a legal challenge by the losing candidate.

Even the spectre of a Supreme Court challenge which repeats the 2000 Bush – Gore “hanging chads” debacle would be very concerning for investors. After the 2000 election, there was a one-month delay before the Supreme Court’s ruling on December 12th. Even more troubling would be a replay of 2020 where President Trump’s protestations of a “stolen election” led to the ‘2021 Capitol Riots’. A constitutional crisis would have significant economic, financial and political implications. Clearly a decisive margin in favour of one Presidential candidate and a supportive Congress would be the preferable constitutional and investment outcome.

Alas, US elections have a history of dramatic twists and turns. However, investors should recognise that politics is just one factor amongst many that can influence their investments. Political events can often prove to be just noise rather than the compelling signal that requires a response. Taking a disciplined long-term approach to investing requires experience as well as resilience. MLC’s investment team will be actively managing your portfolio over coming months to take account of these possible political risks.

Notes:

1 ‘Latest 2024 National Presidential Election Polls’, realclearpolitics.com/epolls/latest_polls/national_president/index.html, 1 October 2024.

2 ‘Betting Odds – 2024 U.S. President’, realclearpolling.com/betting-odds/2024/president, 1 October 2024.

3 ‘Penn Wharton Budget Model’s Guide to the 2024 Presidential Candidates’ Policy Proposals’, budgetmodel.wharton.upenn.edu/2024-presidential-election.

4 ‘The International Economic Implications of a Second Trump Presidency’, McKibbin W, Hogan M, and Noland M, Peterson Institute for International Economics Working Paper 24-20, piie.com/sites/default/files/2024-09/wp24-20.pdf, September 2024.

5 ‘International Monetary Fund (IMF) Global Debt Database - General Government Debt’, imf.org/external/datamapper/GG_DEBT_GDP@GDD/SWE, 2022.

6 ‘Government Debt and Risk Premia’, Liu Y, Journal of Monetary Economics 136, May 2023.

Important information

This communication is provided by NULIS Nominees (Australia) Limited (ABN 80 008 515 633, AFSL 236465) as trustee of Plum Super the MLC MasterKey Fundamentals Super and Pension and MLC MasterKey Business Super products which are a part of the MLC Super Fund (ABN 70 732 426 024 (together ‘MLC’ or ‘we’), part of the Insignia group of companies (comprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate) (‘Insignia Financial Group’). The capital value, payment of income and performance of any financial product referred to in this communication are not guaranteed. An investment in any financial product referred to in this communication is subject to investment risk, including possible delays in repayment of capital and loss of income and principal invested. No member of the Insignia Financial Group guarantees or otherwise accepts any liability in respect of any financial product referred to in this communication.

The information in this communication may constitute general advice. It has been prepared without taking account of an investor’s objectives, financial situation or needs and because of that an investor should, before acting on the advice, consider the appropriateness of the advice having regard to their personal objectives, financial situation and needs. Investors should obtain the relevant Product Disclosure Statement or other disclosure document relating to any financial product which is issued by MLC, and consider it before making any decision about whether to acquire or continue to hold the product. A copy of the Product Disclosure Statement or other disclosure document is available on mlc.com.au or plum.com.au.

Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market. The performance returns in this communication are reported before deducting management fees and taxes unless otherwise stated. Actual returns may vary from any target return described in this communication and there is a risk that the investment may achieve lower than expected returns. Any projection or other forward-looking statement (‘Projection’) in this document is provided for information purposes only. No representation is made as to the accuracy or reasonableness of any such Projection or that it will be met. Actual events may vary materially.

This information is directed to and prepared for Australian residents only. Any opinions expressed in this communication constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to their accuracy or reliability (which may change without notice) or other information contained in this communication.

MLC may use the services of any member of the Insignia Financial Group where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.

Bloomberg Finance L.P. and its affiliates (collectively, ‘Bloomberg’) do not approve or endorse any information included in this material and disclaim all liability for any loss or damage of any kind arising out of the use of all or any part of this material. The funds referred to herein is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds.