Setting up salary sacrifice super contributions

To contribute to your super via salary sacrifice, you’ll need to set up a deduction from your before-tax pay through your employer. We recommend you have a chat to your employer or payroll to make sure you’re able to make before-tax contributions from your pay into your super account.

Consider the Concessional Contribution cap so that you don’t end up paying more tax than you need. Also, make sure you are eligible to contribute before making a contribution.

Step 1

Talk to your employer about your options to set up a salary sacrifice arrangement and how much you’d like to deduct from your pay. And, understand if salary sacrifice contributions will impact any other employment entitlements such as termination payments, bonuses and employment benefits.

Step 2

If the arrangement is right for you, complete our salary sacrifice form and give it to your employer so that they can set up the contributions from your before-tax pay into your super.

Setting up BPAY

You can also set up a one-off or regular contribution via BPAY from your financial institution. To find your BPAY details, log in to your account or refer to your annual statement. Remember, there is a limit on the amount of contributions you can make without tax penalty so make sure you understand how your contribution will be treated.

Step 1

Log in and choose Add money to my super

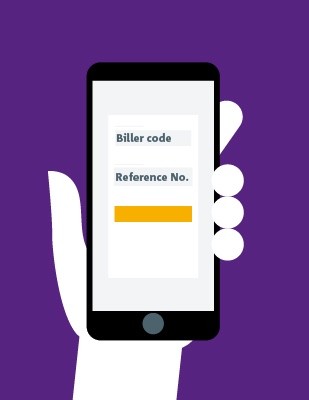

Step 2

Click contribute using BPAY and record the Biller code and Reference Number

Step 3

Log in to your online or mobile banking to contribute to your super.

Things to consider

Adding to your super now can mean more at retirement. Consider the Concessional Contribution and Non-Concessional Contribution caps before contributing so that you don’t end up paying more tax than you need. Also, make sure you are eligible to contribute before making a contribution.

Limits on how much you

can add to your super

Make sure you don’t pay extra tax by understanding how the limits (or caps) work.

Eligibility to contribute

To be eligible to contribute to super, you may need to meet certain age and work conditions.

Tax deductions

You may be able to claim your voluntary (personal) contribution(s) as a tax deduction and reduce your assessable income.