Australia’s inflation remains a concern, but there’s still hope

October 2025

Bob Cunneen, Senior Economist and Portfolio Specialist

5 min read

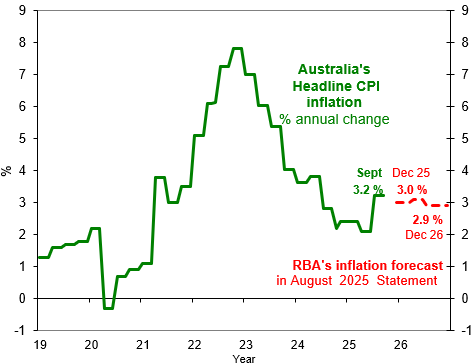

After the peak of 7.8% in December 2022, Australia’s consumer inflation had been grinding downwards. However, the recent inflation result has proven to be a disappointment. Australia’s consumer inflation rate has come in at 3.2% in the year to September 2025 (Chart 1). Given that this is above the Reserve Bank of Australia’s (RBA) 2% to 3% target range for inflation, both consumers and investors are worried whether inflation is again a threat.

Chart 1: Australian consumer inflation

Sources: Australian Bureau of Statistics and Reserve Bank of Australia.

Why is the RBA forecasting that inflation will stay near 3% for the next year?

For the central bank, stubborn inflation around 3% is not a shock. The RBA’s judgement in August was that the Federal and state governments’ various electricity rebate measures are only temporary and that inflation would climb back to 3%.

“The extension of the Energy Bill Relief Fund is due to expire by the end of 2025, which will see year-ended inflation around 3 per cent through most of 2026.”1

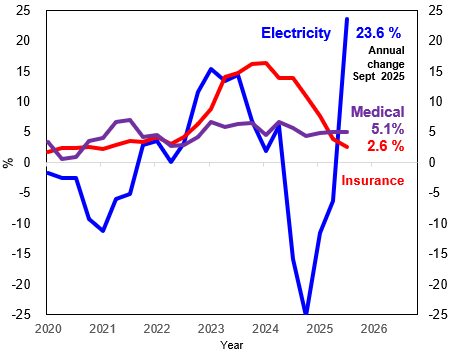

The RBA’s judgement has been vindicated by the sharp 9% rise in electricity prices in the September 2025 quarter. This brings the annual rise in electricity prices to 23.6% (Chart 2).

The “cost of living” is also being experienced with other “essentials”

There have been more persistent price pressures in health care and insurance that remain troubling for consumers as well as the central bank. These consumer prices have been rising sharply over the past four years. In the year to September 2025, hospital and medical costs increased by 5.1%. Given Australia’s ageing population with more complex health needs, there seems to be limited prospects for medical costs being contained.

Chart 2: Australia’s troubling price pressures

Source: Australian Bureau of Statistics.

For car and housing insurance, a profound lack of competition has seen consumers squeezed by rising premiums. Indeed, in the period since March 2020 when the Pandemic started, insurance costs have risen by 46% compared to broader consumer price rises of 23%. Essentially insurance inflation has been ‘double trouble’ for consumers. However, there are early signs that insurance inflation is finally moderating with the recent annual increase of 2.6% well below the 14% peak inflation in 2024.

Australia’s inflation should moderate rather than accelerate higher over the next year

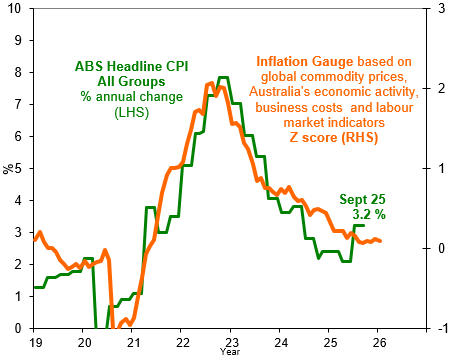

Given the angst over the September’s higher inflation result, there is still hope for lower inflation next year. MLC’s inflation gauge suggests Australia’s inflation pressures are more timid than threatening (Chart 3). This inflation gauge takes into account a range of fundamental factors such as global commodity prices, Australia's economic activity and cost measures to forecast future inflation.

Chart 3: Australia’s inflation pressures appear more timid than threatening

Source: Australian Bureau of Statistics.

Firstly, one needs to be humble about this inflation gauge. Inflation is impossible to precisely forecast. The former head of the US central bank Dr Ben Bernanke has noted that “Modern economies are complex and ever-changing, and they are subject to unpredictable shocks.”2 The sharp rise in Australian and global inflation in 2021-2022 after the Pandemic and Russia’s invasion of Ukraine is a timely warning of how dramatically and rapidly price pressures can emerge and persist.

Allowing for the fact that this inflation gauge is not a perfect forecasting measure, there is evidence to suggest that Australia’s inflation should moderate over the coming year. Australia’s current subdued economic activity should keep price pressures in check. In recent months, there has been a slowdown in household spending as well as job creation. Australia’s unemployment rate has risen by 0.5% to 4.5% in the past year to September which indicates that the job market is soft rather than strong. Hence instead of the solid revival in Australia’s economic activity forecast by the Federal Government and RBA, the reality is that the Australian economic activity is currently subdued. Further upside risks to inflation beyond the September quarter should be limited by this subdued economic activity.

The RBA has cut the cash interest rates three times this year in February, May and August. The current high inflation should caution the central bank against cutting interest rates again this year. Yet provided Australian price pressures moderate as suggested by the inflation gauge; there is still hope that the RBA will be contemplating lower interest rates again next year.

Sources:

1. ‘Statement on Monetary Policy - August 2025’, Forecasts (page 8), Reserve Bank of Australia.

2. ‘Forecasting for monetary policy making and communication at the Bank of England: a review’, Dr Ben Bernanke, April 2024,

bankofengland.co.uk/independent-evaluation-office/forecasting-for-monetary-policy-making-and-communication-at-the-bank-of-england-a-review/forecasting-for-monetary-policy-making-and-communication-at-the-bank-of-england-a-review.

Additional sources:

‘Consumer Price Index, Australia for the September Quarter 2025’, Australian Bureau of Statistics (ABS), released 29/10/2025.

Important information

This communication is provided by NULIS Nominees (Australia) Limited (ABN 80 008 515 633, AFSL 236465) as trustee of Plum Super the MLC MasterKey Fundamentals Super and Pension and MLC MasterKey Business Super products which are a part of the MLC Super Fund (ABN 70 732 426 024 (together ‘MLC’ or ‘we’), part of the Insignia group of companies (comprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate) (‘Insignia Financial Group’). The capital value, payment of income and performance of any financial product referred to in this communication are not guaranteed. An investment in any financial product referred to in this communication is subject to investment risk, including possible delays in repayment of capital and loss of income and principal invested. No member of the Insignia Financial Group guarantees or otherwise accepts any liability in respect of any financial product referred to in this communication.

The information in this communication may constitute general advice. It has been prepared without taking account of an investor’s objectives, financial situation or needs and because of that an investor should, before acting on the advice, consider the appropriateness of the advice having regard to their personal objectives, financial situation and needs. Investors should obtain the relevant Product Disclosure Statement or other disclosure document relating to any financial product which is issued by MLC, and consider it before making any decision about whether to acquire or continue to hold the product. A copy of the Product Disclosure Statement or other disclosure document is available on mlc.com.au or plum.com.au.

Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market. The performance returns in this communication are reported before deducting management fees and taxes unless otherwise stated. Actual returns may vary from any target return described in this communication and there is a risk that the investment may achieve lower than expected returns. Any projection or other forward-looking statement (‘Projection’) in this document is provided for information purposes only. No representation is made as to the accuracy or reasonableness of any such Projection or that it will be met. Actual events may vary materially.

This information is directed to and prepared for Australian residents only. Any opinions expressed in this communication constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to their accuracy or reliability (which may change without notice) or other information contained in this communication.

MLC may use the services of any member of the Insignia Financial Group where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.

Bloomberg Finance L.P. and its affiliates (collectively, ‘Bloomberg’) do not approve or endorse any information included in this material and disclaim all liability for any loss or damage of any kind arising out of the use of all or any part of this material. The funds referred to herein is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds.